“How much to charge as a freelancer?” is arguably the second most common question after “Where do I find freelance clients?”

Pssst, did you know we’ve already answered it in a new eBook? (Written by yours truly. 🥰)

Every freelancer I know (myself included) still wonders how much to charge for this or that. You have the power to set your own prices, but also carry the responsibility for quoting too low or absurdly high (which is rare). On the contrary, 32% of freelancers say to have overserved their clients at least once and some 29% overserved at least half of their clients.

Exceeding expectations is amazing because great customer experience leads to more business.

But the tendency to underprice ourselves also creates a negative industry dynamic. Some clients struggle to understand the true costs of freelance services as Brooklin Nash of Beam Content points out:

Source: Twitter

So how to determine a freelance rate that works for you and for your target clients?

🚨Spoiler: There’s no universal solution to the freelance price-setting dilemma, but rather a series of strategies you should test.

.png?width=2401&height=2446&name=01_Pricing%20methods%20and%20formulas%20for%20freelancers_version%201%20(1).png)

Buckle up and let’s dive into the variable world of freelance rates.

4 popular pricing options for freelancers

To set a reasonable freelance rate, you need to assess all options on the table:

- Hourly rates

- Project-based (fixed-price)

- Day rate

- Retainers

The good news is that you don’t have to settle for one freelance pricing model. You can use a combo!

However, Multiple pricing structures and tiers leave plenty of room for doubt. That kinda makes you like Goldilocks: You have to try different rates to figure out which one is “too big,” “too small,” or “just right.”

(But since you don’t want to be as obnoxious as that fair-haired lady, don’t try this method on the same client.)

Instead, test different freelance rates on different types of projects, then analyze how your income and job satisfaction change.

With that in mind, let’s get down to your options.

Hourly pricing for freelancers

This is simple: an hour of your freelance time costs X dollars/euros/pounds.

Hourly rates are a time-tested pricing model going back to the 19th century. Once the clock — as a precise method of time-tracking — became omnipresent, an hour became the most common benchmark for work.

That’s still the case in the 21st century. In the US, 58% of all wage and salary workers are paid by the hour. Others get a lump sum biweekly/monthly, which is still tied to the number of weekly/monthly work hours spelled out in the contract.

Because an hourly wage feels familiar to many employers, freelance marketplaces also went with the hourly model — and so did many independent contractors working solo.

Pros of hourly pricing:

- Widely accepted by clients

- Covers scope creep/project changes

- Predictable workload (if fixed hours)

- Easy client reporting and invoicing

Cons of hourly pricing

- Doesn’t always reflect the end value of work

- Limits earning potential

- Prompts slower work for higher pay

- Easy to underprice yourself

- Doesn’t compensate for non-billable hours

How to calculate your hourly rate as a freelancer

Use this quick formula to set your freelance hourly rate:

Comfortable takeaway pay + % of tax overheads + % of price premium = Good hourly rate

or

$60 + 15% + 10% = $75 per hour

Now let’s break it down.

Comfortable takeaway pay is an hourly wage you’ll feel content with. It should also reflect:

- The nature of your services. Specialized work (e.g. legal consulting) always costs more than lower-qualified work (e.g. photo retouching)

- Your experience levels. A pro vs beginner freelance rate stands on the opposite end of the pricing spectrum

- Average market rates. Analyze how much freelancers in your domain charge per hour. Then browse in-house salary comparisons to approximate a good going rate

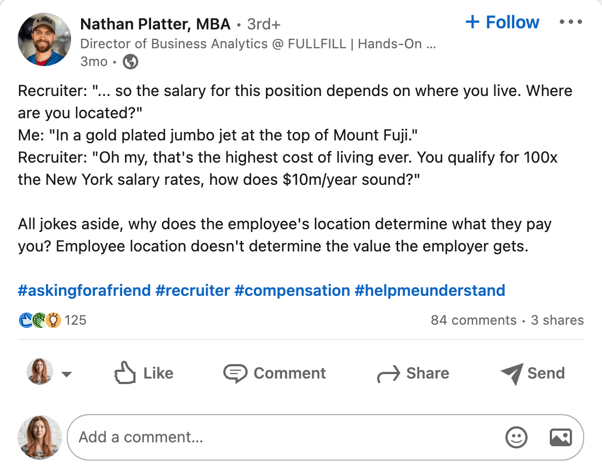

To determine market rates as a freelancer you should also take your location into account, but do so strategically. If you live in an HCOL area, you can’t charge peanuts. But living in a LCOL area doesn't mean you should quote lower rates (unless you want to give a discount).

The freelance economy is borderless. You should be paid a wage appropriately proportionate to the value you are generating for the business (not your location).

Source: LinkedIn

Percent of tax overheads. As a self-employed person, you foot your own tax bills and pay your social benefits. This translates to lower payroll costs for employers and is a frequent reason for hiring freelancers.

But you shouldn’t fully exclude those costs from your hourly rates, or else you'll end up with the short end of the stick. Depending on your location and income bracket, add an extra 15%-35% to your hourly rate to cover tax overheads.

Percent of a price premium. If you are an experienced, in-demand freelancer who can deliver above-average value for the client, command a price premium.

What does “above-average value” mean?

- You don’t just deliver a service, you also consult, audit, or educate the client in other ways

- You can work faster thanks to past experiences and require less guidance or supervision

- You were hired for a short-term, high-value project. For example, to create a new logo that will be plastered everywhere

In other words: Your work goes beyond standard execution — it directly affects the client’s bottom line now and for years to come.

Set your freelance hourly rate proportionally to your industry and experience levels. Few people question why a lawyer charges $250+ an hour for a consult. If you have strong credentials and heaps of experience, this should be reflected in your pricing.

But if you are a beginner, settle for a more modest (but adequate!) hourly rate which is at least 3X the minimum hourly wage in your country.

Remember: your freelance rate should be tied to the value the client gets (more on this in a bit).

Freelancer hourly rates database

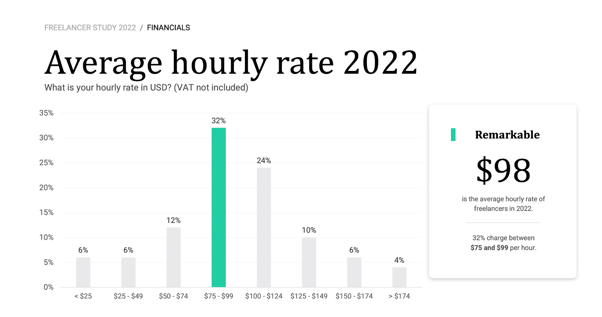

Need some ballpark numbers? Here are 2022 statistics on average freelance hourly rates.

Source: Freelancer 2022 Study by Freelancer Map

- Average hourly rate among European freelancers — $98/hour (without VAT)

- Average hourly rate among US freelancers on Upwork — $28/hour (across all professions)

- Average hourly rates for freelance web developers — $61-80/hour (globally)

Unsurprisingly, freelance hourly rates are all over the spectrum. That’s pretty similar to salary data. Depending on the experience and location, a graphic designer can get paid anywhere between $20k per year to $65k per year.

Pro tip: Xolo uses the European average on pricing to ensure that freelancers are paid what they deserve when offering talented and professional services. Undercutting and low-quality bidding wars are soon to become a thing of the past.

Project-based pricing for freelancers

Per project (fixed) pricing is the second go-to option for freelancers. In this case, you set a round price for end-to-end service delivery e.g. $500 for one blog post.

Fixed prices work best for deliverable-based work (e.g. 25 product photos) and well-scoped tasks (5-page online store design), rather than long-term, multi-stage projects.

That said: you can estimate a fixed-price rate for almost any type of freelance service the same way agencies do. In this case, you have to calculate the total number of billable hours for each stage of the project. Then add extra padding to account for changes, scope creep, and end-client value.

Pros of project-based pricing

- Predictable paycheck

- Value-oriented

- Higher revenue potential

- Easier to raise prices

Cons of project-based pricing

- Harder initial estimation

- Doesn’t account for scope creep

- Doesn’t work for all types of jobs

How to set a fixed-project freelance rate

Once again, here’s a formula to calculate a fixed-price rate as a freelancer:

% of buffer pricing + (Hourly Rate x № of Billable Hours) = project rate

or

25% + ($75 x 5/h) = $470 (rounded)

Now let’s see what goes into this calculation:

Percentage of buffer pricing. Add an extra 25%-35% to any fixed rate you have in mind to account for scope creep, unplanned expenses, underestimation, and other “oh 🤬!” issues that can happen.

Hourly rate. That’s your desired rate per hour which covers taxes and reflects your experience levels.

Billable hours. Your billable hours as a freelancer are an estimate of how much time you’ll really spend working on the project. These don’t account for any other “admin” you do such as following up with the client for updates or getting your accounting in order (something Xolo helps with tremendously!)

All of the above make up one approach to project rate estimation. Here’s another: pricing your work by a quantifiable parameter such as:

- Total word count (for blog posts)

- Number of website pages (for design)

- Total video length (for videography)

Then add an extra profit margin to cover all the non-billable hours you incur as a self-employed person.

Most freelancers use a combo of parameters to come up with the ideal project rate:

- Number of deliverables

- Estimated hours

- Complexity of work

- Experience levels

- Client industry

- Client price tolerance

Next, pack all of the above into a price quote or project proposal with an a lá carte view of what’s included (and what’s not).

Freelance project rates by industry

To quote more accurate fixed price rates, check what others charge for similar types of work. But treat all sample freelance rates as ballparks, rather than definite rates for your industry.

|

Profession |

Project type |

Pricing |

|

Freelance writers and copywriters |

Blog Post |

$250-399 |

|

Editorial Piece for Newsletter |

$200-$500 |

|

|

Case Study |

$1,200-$2,000 |

|

|

SEO and Sales-conversion Copy |

$500-$1,250/page |

|

|

Freelance SEO specialist |

Site Content Audit and Report |

$1,000-$2,500 |

|

Keyword Research |

$500-$1,500+ |

|

|

SEO Audit |

$501-$1,000 |

|

|

Social Media Marketers |

Social Media Management: Facebook, Twitter, Instagram |

$1,000-$2,000 per month |

|

Social Media Ad Campaign Setup |

$500 per campaign |

Data sources: PeakFreelance, American Writers & Artists Institute, Ahrefs,

Day rates for freelancers

A day rate is a fixed sum you’d accept for exclusively working for one client for a day. As Linda Evangelista once said, she doesn’t “get out of bed for less than $10,000 a day.”

Historically, day rates were the go-to compensation model for regular employment before hourly rates. In Renaissance times, you paid your contractor by the day because there wasn’t an easy way to figure out how many hours they worked (no Apple Watch back then 😄).

Today, day rates are still popular in the UK and EU (and slightly less in other parts of the world).

A day doesn’t necessarily have to be 8 full hours (unless that’s what your client contract says). Your pricing might be more value-oriented, rather than time-bound i.e. you accept to do a set host of tasks in several days for $X money.

Pros of day rates

- Steady income

- Easier estimation

- Value-oriented pricing

- Tiered pricing packages

Cons of day rates

- More complex work scheduling

- Challenging to scale up / raise rates

- Unreasonable client expectations

- Might not account for project complexities

How to calculate a day rate for a freelancer

Let’s start with a day rate formula:

(Annual salary for a similar role + % of tax overheads ) / number of annual workdays = day rate

or

($50,000 + 30%) / 220 = $300 per day (rounded)

Percentage of tax overheads covers the benefits, social contributions, and taxes you pay out of pocket as a self-employed person.

Annual salary information is easy to look up on salary comparison websites like Glassdoor or PayScale.

220 days is the average number of workdays per year. But you should lower this number since few freelancers will be employed year-round.

The above formula provides a ballpark estimate. Feel free to tweak it by adding your price premium percentage to it. Again, if you are ultra-professional, provide a specialized service, and work super-efficiently, you can confidently command a higher day rate.

That said: some clients may challenge your day rate as too high. Don’t be afraid to push back (when it’s warranted) or negotiate by reducing the scope of included “day” services.

Average freelance day rates

Calculate your day rate using these ballpark numbers. Don’t be afraid to go higher if you are a pro and be more flexible if you are a beginner.

|

Industry |

Average Day rate |

Location |

|

Tech |

€492 |

France |

|

€735 |

Germany |

|

|

€230 |

Spain |

|

|

£417 |

UK |

|

|

Marketing/Communications |

€388 |

France |

|

€730 |

Germany |

|

|

€180 |

Spain |

|

|

£353 |

UK |

|

|

Designers |

£336 |

UK |

|

Graphic designers |

£280 |

UK |

|

UX designer |

£500/600 per day |

UK |

|

Film & Motion |

€394 |

France |

|

€560 |

Germany |

|

|

€210 |

Spain |

|

|

£370 |

UK |

Freelancer retainer pricing

Like fixed pricing, retainers come from the agency world. In this case, your clients pay you upfront for a fixed set of hours or deliverables on a recurring basis (e.g. 3+ months).

Retainers work best for ongoing client work, which requires part-time engagement such as:

- Content management

- Editorial services

- Project management

- Marketing consults

You can agree to commit either to a certain number of hours, necessary to cover the client’s scope — or to a fixed set of deliverables to be sent over on a regular basis.

Retainers are a great way to build ongoing client relationships and break the vicious feast-famine cycle. You can also keep your freelance work schedule organized by effectively stacking retainer projects month-on-month. Then add some one-off tasks in between.

This way you’ll always earn a minimum paycheck and take on extra work when you need extra cash.

Pros of retainer pricing

- Stable freelance income

- Easier estimation

- Better client retention

- Higher client experience

Cons of retainer pricing

- Stronger dependence on individual clients

- Don’t suit variable work

- More difficult to raise prices

- Slightly discounted rates

How to calculate retainer pricing

Here are two formulas for calculating retainer rates:

Composable hourly rate (takeaway rate + % price premium) x billable hours = monthly retailer

or

(№ of deliverables x item cost) + %price premium = monthly retailer

You can determine your freelance retainer rate either by estimating a monthly number of billable hours needed to complete the set tasks or by quoting a total for all deliverables.

Essentially, you either calculate an hourly or a project rate. Then multiply it by the duration and add a price premium to cover non-billable work.

To make your retainer pricing more competitive, you can also pitch a structured retainer fee. Propose a minimum project threshold as a floor (e.g. €1,500/mo) and then pitch add-ons, based on the client’s budget, needs, and price tolerance.

As a freelance WordPress developer, you can offer three retainer tiers:

|

Essentials |

Commerce |

Pro |

|

Best for: Small businesses with traffic under 30K mo. Included:

|

Best for: Small to mid-market e-tailers. Included:

|

Best for: High traffic media websites ($100K+), SaaS companies. Included :

|

|

Price: $200/mo |

Price: $1500/mo |

Price: $2,500+ /mo |

Retainers are an excellent way to productize your freelancer services aka standardize your services scope and delivery process to consistently delight clients with your work. Productized services are also easier to subcontract, meaning you can scale your solo operations into a freelance business.

Sample freelance retainer rates

Retainer work is varied. You can have standardized retainer packages for the most frequently requested services or customize one to the client’s needs. This makes ballpark rates hard to find, but we still got you! 😉

|

Profession |

Average retainer price |

|

Monthly retainer fee of $1,670 + $110 per hour on top. |

|

|

Freelance HR consultants |

£250-£500 per small-scale retainer project |

|

$1,001-$2,500 for paid advertising projects |

To set the optimal freelance rate, avoid the billable hours fallacy

Common Internet wisdom suggests a simple way to set your freelance rate: “Just divide your target income by a daily number of work hours and quote that.”

But as Benek Lisefski rightfully argues on the Freelance Code blog (something I personally agree with) is:

“You went through the calculation to come up with an hourly rate. You paid close attention to detail on all the freelance expenses to ensure you didn’t short-change yourself. You’re still going to land short of your goal because your billable hours are a fantasy.”

Even the most productive freelancers spend roughly 60%-85% of their total work time on billable client work. The rest goes toward client acquisition, marketing, negotiations, admin, etc.

So if you think you can bill 8hrs/day, you’d end up actually working 12+ hrs/day. That’s a recipe for burnout.

Likewise, your desired hourly rate (aka when factoring in target income and living costs) may not correspond to the value you are delivering for the client.

Let’s be real: You can earn a good salary by working as an English teacher in K12, but you’ll struggle to command the same rate for doing online tutoring.

Because if you follow the standard freelance pricing equation, here’s what you get:

- Average high school English teacher salary in the US is $50,614.

- Number of work hours in a year: 2,080

- Hourly rate to compensate your FT salary: $24 (assuming you work 8hrs per day)

But if you can book classes for only 4 hours per day, you need to raise your hourly rate to $48 (before taxes). That might already be too high as the average English tutor rate is between $15 and $40 (before taxes).

The above rate also doesn’t cover other freelancer expenses you may incur like platform fees, payment processing costs, hardware or textbook purchases, and so on.

So how can you set better freelance rates? By ditching market rates and switching to value-based pricing.

Source: Twitter

Nothing else determines your rate other than the value clients get from you versus other service providers.

To come up with the optimal freelance rate that makes you happy and clients lining up at your virtual counter focus on increasing your value.

Gain more experience. Refresh your current skill set. Stay at the vanguard of industry changes. Be reliable. Don’t cut corners. Learn to see the bigger business picture — and chip in extra value outside of the direct task you were hired to do.

Your ability to deliver game-changing results for the clients has to drive your pricing, not your annual income goals or location.

About Elena

Elena Prokopets writes content for tech-led companies & software development businesses, marketing to them. Her empathy for the customer, expertise in SEO, and knack for storytelling help create content that ranks well and drives industry conversations.

Elena uses Xolo so she can focus on her solo B2B content writing business without stressing over the compliance and admin overhead.

.png?width=1200&height=100&name=Email_Items%20(6).png)

1. How do I determine the right hourly rate for my freelance services?

To determine the right hourly rate, you should consider several factors:

- Your Experience and Skills: Evaluate your expertise level in your field. More experienced freelancers can typically charge higher rates.

- Market Rates: Research what other freelancers with similar skills and experience are charging. You can use platforms like Upwork or Fiverr to get a sense of current rates.

- Cost of Living: Your rate should cover your living expenses, including rent, utilities, and groceries.

- Business Expenses: Include costs such as software, hardware, office supplies, and marketing.

- Taxes and Benefits: Factor in self-employment taxes and health insurance.

- Desired Profit: Decide how much profit you want to make on top of covering all your expenses.

A common formula to calculate your rate is: Hourly Rate=(Annual Salary + Annual Expenses)×(1+Profit Margin)Billable HoursHourly Rate=Billable Hours(Annual Salary + Annual Expenses)×(1+Profit Margin)

2. What are billable hours, and how do I estimate them?

Billable hours are the hours you can charge a client for your work. They do not include time spent on non-billable activities such as marketing, administration, or breaks.

To estimate your billable hours:

- Determine Weekly Hours: Decide how many hours you intend to work each week.

- Account for Non-Billable Activities: Estimate the time spent on activities that are not directly billable.

- Calculate Annual Billable Hours: Multiply your weekly billable hours by the number of working weeks in a year.

Example: If you work 40 hours a week and estimate 25% of your time is non-billable, your weekly billable hours are 30. With 48 working weeks per year, your annual billable hours would be 30×48=144030×48=1440.

3. How can I adjust my rates for different types of projects?

Adjusting your rates based on project type involves:

- Project Complexity: Higher complexity usually warrants a higher rate.

- Urgency: Projects that require quick turnarounds can be priced higher.

- Client Budget: Understanding a client’s budget can help you adjust your rates accordingly.

- Long-Term Projects: Offering a slight discount for long-term engagements can make your rates more appealing.

You can also consider a tiered pricing structure, where different services or project types have distinct pricing levels.

4. How should I handle rate negotiations with clients?

To handle rate negotiations effectively:

- Be Transparent: Clearly explain your pricing structure and the value you bring.

- Know Your Minimum Rate: Have a clear understanding of the lowest rate you can accept without compromising your profitability.

- Offer Flexibility: Propose different pricing options, such as hourly rates, fixed rates, or retainers.

- Emphasize Value Over Price: Focus on the quality and outcomes of your work rather than just the cost.

- Be Prepared to Walk Away: If a client cannot meet your minimum rate, it’s okay to decline the project.

5. What tools can help me manage and track my freelance rates and income?

Several tools can streamline rate management and income tracking:

- Invoicing Software: Tools like Xolo Go, FreshBooks, or QuickBooks help generate invoices and track payments.

- Time Tracking Apps: Apps like Toggl, Clockify, or Harvest can track billable hours accurately.

- Expense Management Tools: Tools such as Expensify or Zoho Expense help track and categorize business expenses.

- Financial Dashboards: Platforms like Xolo Go provide real-time insights into your income and expenses, helping you adjust rates as needed.

These tools not only help in accurate billing but also in maintaining compliance and optimizing your business finances.

Related blogs

Subscribe to

our newsletter

and get the latest updates and expert

business tips straight to your inbox.