For Walt and Jesse in Breaking Bad, the cost of doing business meant being ready to blow away all rival drug dealers and cops that stood in their way... Luckily for you, while every business has some costs associated with it, the operational expenses of running a business in Estonia are rather more minimal and less ruthless — in fact, they may surprise you with their simplicity.

How much does it cost to become an Estonian e-resident?

For most would-be e-entrepreneurs, the first step to setting up your business will be becoming an Estonian e-resident.

This crucial stage involves the application for, and acquisition of, your digital identity card — which is the key to unlocking the entire Estonian digital infrastructure you will need to operate your new company, and interact with the various statutory bodies in Estonia.

The card is issued by the Estonian Police and Border Guard Board, and you apply for it online (of course); however, it will need to be collected in person — this may be done in Estonia, or from a collection point closer to you. These are usually located in Estonian embassies around the world, and more and more of these are being initiated all the time.

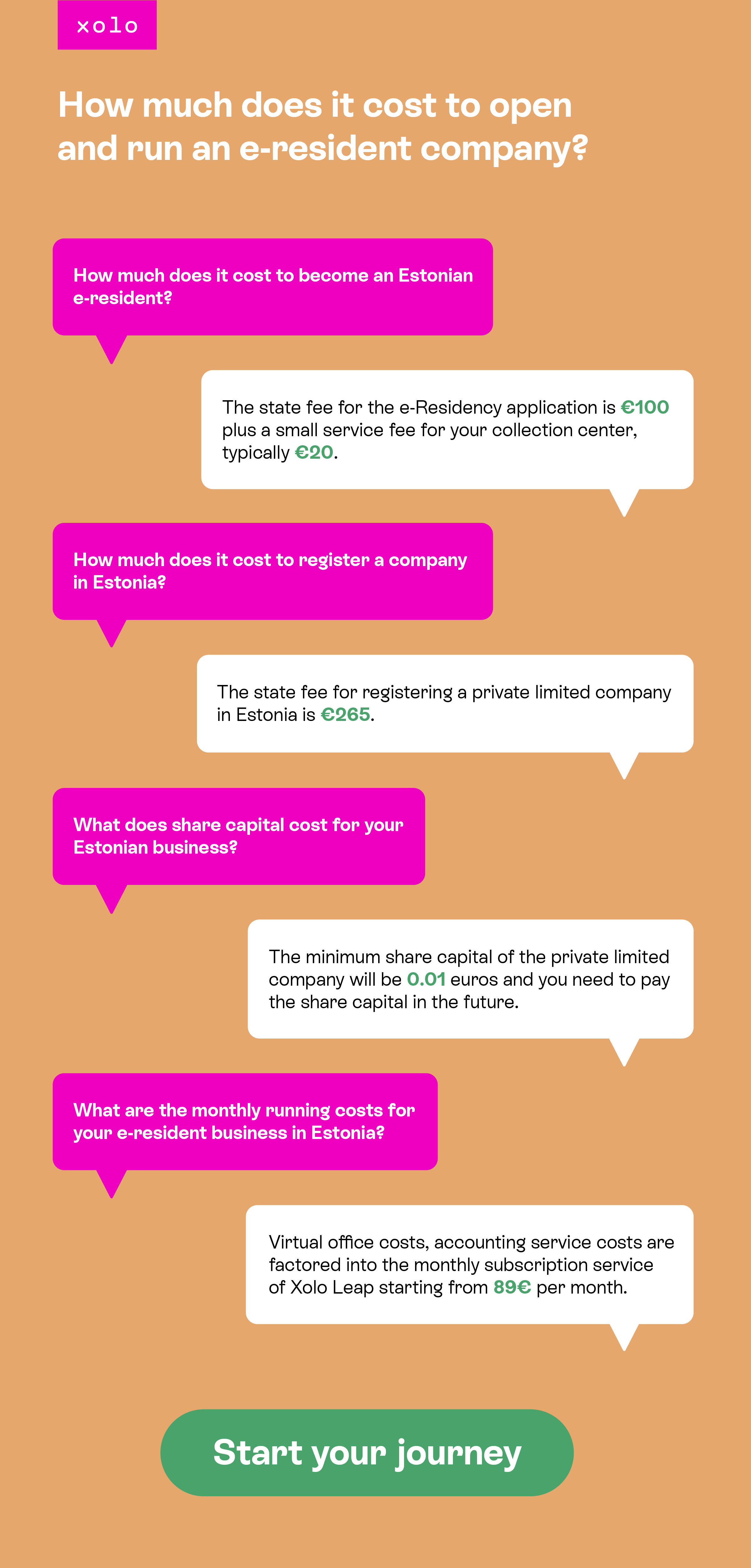

The state fee for the e-Residency application is €100 (payable by credit card at the point of application), plus a small service fee for your collection center, typically €20. You will also need to factor in travel costs and time to your nearest collection point — in Europe this will probably just mean a jaunt to your nearest capital city, but it could be much further. You don’t have to visit Estonia for it though, unless you want to!

The e-Residency digital ID card is valid for 5 years, at which point you will need to renew it, via a similar process. As such, you can regard the cost of e-Residency as typically around €20 per year, + your travel… Not bad, when you consider everything that small piece of blue and white plastic unlocks for you, in e-Estonia!

Incidentally, this process can take several weeks, for the border police to assess your application and offer you an appointment. So you may need to factor this in to your operational planning, for launching your new business.

How much does it cost to register a company in Estonia?

Compared to waiting for your ID card and taking a day trip to your nearest collection center, registering your e-resident Estonian business will happen blazingly fast! Provided you have already thought through important decisions like your business name and primary activities, Xolo Leap will get you registered in less than one business day! Or, it may be quicker than that — the record presently stands at 15 minutes and 33 seconds!

The state fee for registering a private limited company in Estonia is €265. So in less than one day, you will be a company director, as the sole shareholder and board member of your limited liability company (owning 100% of the shares.)

This kind of business is ideal for most solopreneurs and micro-enterprises, though of course there are many other structures (and associated costs) which may apply as you grow… Or not, if you remain a company-of-one forever! There may also be fees for certain kinds of regulated industries with higher risk and compliance demands, but the private limited company (OÜ, "osaühing" in Estonian) suits most ‘Xolopreneurs’ very well for the long term.

Unlike in many other countries, setting up an OÜ in this way does not require the services and fees of a notary, nor do you need to pay any share capital upfront.

So, that’s it!

Related read: A step guide to setting up your Estonian business using e-Residency.

Are there any other set-up costs for your e-Resident Estonian business?

Once you have your ID card and your OÜ established, you’re in business!

However, depending on your value-generating activities, you may have other costs to consider — such as investment in the technology and materials you need to work. All of these are legitimate business expenses now, so be sure to collect and file detailed VAT receipts, for that shiny new Mac or full-color brochure. And it will simplify things to get software-as-a-service subscriptions set up in your business name too.

You will also need a means of paying for this stuff, as well as receiving payments into your business — so that means banking.

At this point, you may well be able to operate with a fintech provider, like Estonian global success story Wise, which you can set up pretty much instantly online, and the only fees you will pay are for currency exchange.

Depending on your needs and activities, you may require a full clearing bank service, in which case Xolo can help you get set up with an Estonian bank such as LHV. This will give you access to services like investments, credit, and so on — but, will require a face-to-face appointment in-branch at some point, to confirm your identity and credentials. Again, Xolo Leap will help arrange this, and it is advisable not to make travel plans until the meeting is confirmed.

All banks have their own schedule of fees for the professional services they provide, so you will want to compare these carefully to best select the correct provider for your needs.

What does share capital cost for your Estonian business?

Every business will require share capital investment at some point, and Estonia is no different — this effectively creates the legal business entity differentiation, from yourself as a sole trader.

From 1 February 2023, the minimum share capital of the private limited company is 0.01 euros. With that low minimum threshold, you need to pay the share capital in the future. During this time, you can operate your business normally in almost all respects, including paying yourself a salary or consultancy fee; however, there may be additional personal liabilities, and you cannot pay out a dividend until the share capital is paid.

When you’re ready to pay the share capital, your Xolo accountant will instruct you on the straightforward process. But you don’t have to worry about it when you are setting up initially.

What are the monthly running costs for your e-resident business in Estonia?

Once your business and banking are sorted, you’ll want to get trading and earning money — so jump in, and go for it!

However, every business has ongoing costs associated with it, and as a new operation, you will want to streamline and minimize these.

Virtual office costs in Estonia

Businesses owned and operated by foreigners are required by law to have a legal representative located in Estonia, and Xolo Leap provides this virtual office role as part of the package you are subscribed to.

This keeps you legal, and provides you with a registered business address in a prestigious EU city, for all your invoicing and correspondence too.

All Xolo Leap packages include access to the streamlined dashboard and tech stack which enables the most frictionless business administration services imaginable — being able to file expenses, raise invoices, manage business trips, and see your multi-currency cash position, all in seconds.

So, your business ‘office’ is wholly virtualized as well — saving you hours of poring over spreadsheets and pieces of paper, that you may associate with traditional business administration, and minimizing your admin time costs of doing business.

Accounting services fees in Estonia

A considerable proportion of your Xolo Leap subscription fee to support the harmonious combination of bespoke software automation and intelligent human expertise, which underpins the accounting service you receive.

All the Xolo Leap packages include the automated management of sales, expenses, VAT, banking, travel, and compliance. And depending on your needs, you can also add management accounting, salary management, and the use of payment gateways as well, all within a single, predictable, monthly subscription.

Other monthly running costs for your Estonian company?

Of course you may well have additional software needs, information products, and other things you pay for as part of your business activities.

Make sure these are all logged as business expenses, and for good cashflow management, it’s a good idea to review your operational tech stack on a regular basis. Could one thing you are paying for, do the work of several? Are you still reading that essential publication?

Staying lean and proactive will help you manage your cashflow, and maximize your profits!

What are the annual running costs for your e-resident Estonian business?

Many aspects of the business accounting cycle operate on an annual, rather than monthly basis, such as preparation and presentation of the annual report.

The good news for Xolo Leap customers though, is that all these activities are factored in to the monthly subscription service, and there are NO additional fees for preparing the annual report, calculating dividends, or other annualized activities. This means you can continue to focus on your core business activities without worrying about unexpected bills and expenses.