How To Invoice As A Freelancer? Answers To All Your FAQs

on April 16, 2025 • 13 minute read

Watching the money growing in your business account is thrilling. But invoicing clients as a freelancer — not so much.

Invoice terms, tax regulations, payment processing intricacies — there are a LOT of questions you probably have about invoicing (and there’s never a dumb question when it comes to money management!).

This guide gives straightforward answers to all the pressing questions you have about creating, sending, and managing client invoices.

What is a freelancer invoice?

A freelancer invoice is a document you send to a client to request payment for the provided services. Like a store receipt, an invoice lists all the items purchased, the total amount due, and the payment terms.

An invoice also serves as your proof of income for tax purposes. Should the local office come asking about the nature of your revenue, you can provide them with copies of your invoices, proving exactly how you made all that money!

Unless you’re working via a freelancer marketplace (which auto-generates invoices), you’ll have to create and send invoices to each client.

When to send invoices as a freelancer?

You’re the boss so you get to choose when to invoice clients. Most freelancers send an invoice before and/or after delivering the service. You can request a project deposit (e.g., 50%) or a retainer (e.g., 100% prepayment) before sitting down to do the work. Or you can invoice the client in full after delivering the service.

Choose the invoicing schedule that works best for your clients and your cash flow.

Is it mandatory to make an invoice as a freelancer?

Yes, legally you’re obliged to send invoices to each client for rendered services (unless you’re relying on a freelance marketplace or a talent management platform to do so on your behalf). You can forgo an invoice for any services delivered in person, however, if neither you nor the client are a VAT-registered entity. But you’re still obliged to provide a payment receipt and an invoice copy should the client request one.

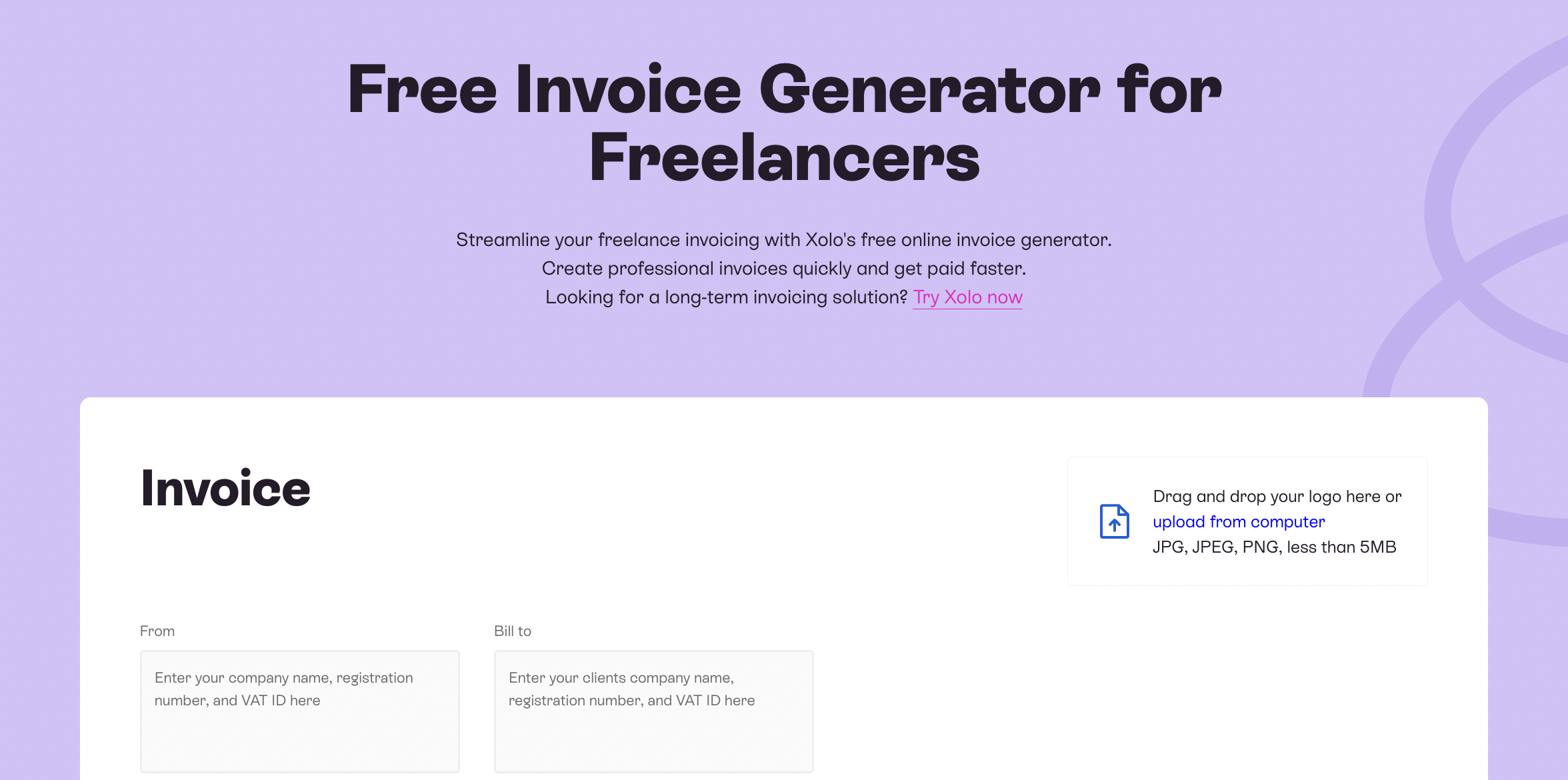

Is there a free online solution?

Yes, there is. Utilize our convenient and user-friendly invoice generator for freelancers to effortlessly create polished and professional invoices. Customize your invoices by adding your logo, including the necessary details such as the sender and recipient information, sales item descriptions, amounts, tax amounts, your bank details and easily download the finished invoice in PDF format. Try now for free →

What to include in a freelancer invoice?

A standard freelancer invoice has three elements:

- Header area: Invoice number, date, and due date, followed by your contact information and the client’s contact information (+ company details for both).

- Body area: Itemized breakdown of provided services (or sold products) with pricing, discounts, and taxes included.

- Footer area: Payment method and payment terms (plus any personal notes on the project or just a quick “thanks!”).

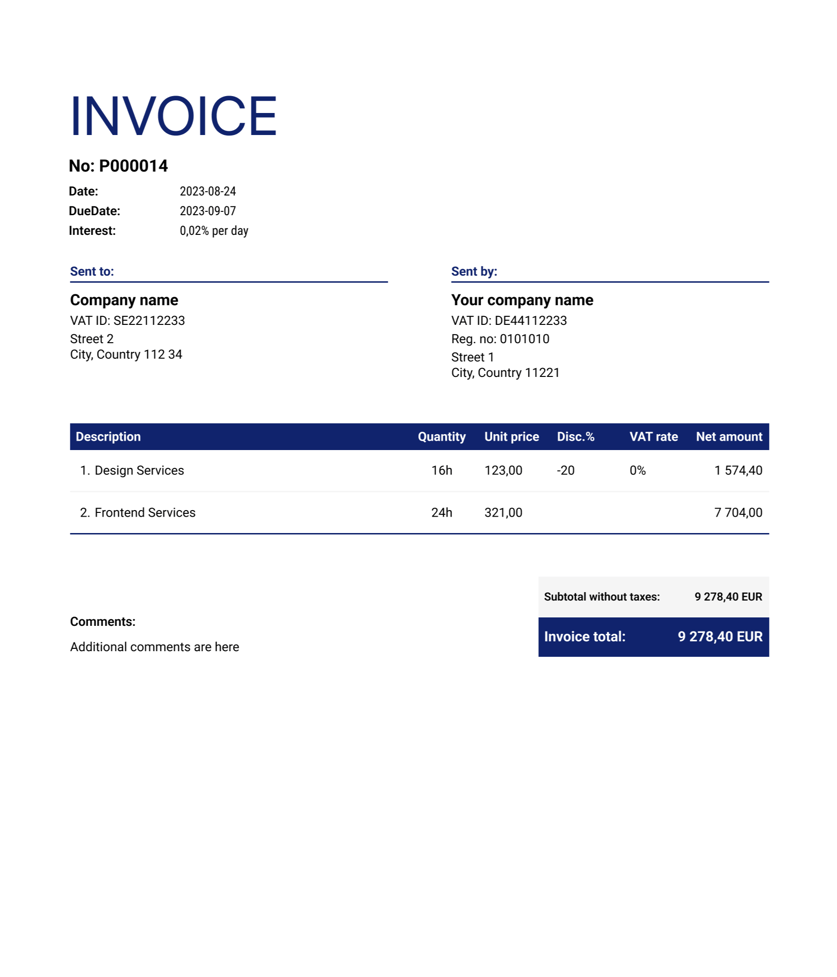

Sample freelancer invoice by Xolo

Invoice number

Every invoice must have a unique number for bookkeeping and tax compliance purposes. If you ever get audited (highly unlikely, but it does happen), a sequential invoice trail will help cross-correlate reported income with incoming payment transactions.

Establish a chronological, five or four-digit numbering system for your invoices (e.g., 00001). A bigger starting number gives you plenty of room for growth.

You can also codify other information into your invoice number to identify customer invoices faster. For example:

- Assign each client a unique project number: e.g, 01 (client one), and then a unique inventory number (e.g., 0001) aka the first invoice for them.

- Include an invoice date to the invoice number e.g., 2023-03-22–0101 would stand for the first invoice for the first client, issued on March 22nd, 2023.

Or you can go with a numbering system, suggested by your invoicing app.

Invoice dates

An invoice must also include two important dates:

- Issue date

- Payment due date

An issue date indicates when you’ve sent the bill. An invoice due date states when you expect the client to pay the invoice. With a fixed due date, you can easily track overdue invoices.

The time in-between these two dates is called an invoice payment term (more on this in a bit!).

Optional: Interest rate

To avoid late payments (oh-so-common for freelancers) you can charge an interest rate on late payments i.e. a penalty for each day the invoice remains unpaid.

The standard monthly interest rate for late business payments is between 1% and 2%. Though, legally you’re allowed to charge late fees as high as 10.50% per annum (in the EU) and 8% (in the UK).

You can use a free late payment interest calculator from the EU commission to model different penalty scenarios. (Though here's hoping you won’t have to resort to that!).

Contact details

The next section of an invoice header is contact details — yours and your customer's. Typically, the client's details go first (in the left column) and the freelancer’s details go second (in the right column).

In both cases you need to include:

- Full client name (company name or company representative)

- Legal address (street, city, country)

- Company registration code and/or tax number

The above details are sufficient in most jurisdictions, but you should always double-check with a local authority if you’re in doubt.

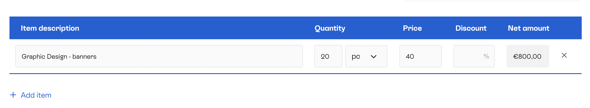

Breakdown of services

An itemized list of sold services or products makes up the bulk of your invoice. Add a detailed description of the services or products sold, the quantity, and the unit price.

A service description can include a project name (e.g., Content Strategy Consulting for Awesome Client) and/or service type (e.g., Web Design Services - Landing Page).

Always add a detailed service description. Why?

Because it avoids:

- Unnecessary communication with the tax authorities, wondering about the nature of the delivered services.

- Payment delays from clients, whose accounting team couldn’t figure out how to attribute your payment request to a specific cost center.

To save space, consolidate same-priced services into one line, but indicate the total number and total price. For example:

Likewise, you should consolidate all billable hours into one invoice line (e.g., 10 hours x $45 = Net amount of $450).

Extras: Applicable taxes

Tax collection may be a legal requirement based on your country of incorporation.

If you’re operating out of the EU or the UK, your freelance services may be subject to value-added tax (VAT).

VAT is due when:

- Your business income exceeds a taxable revenue threshold (e.g., over 40,000/year in Estonia).

- You’re selling digital or physical products to EU consumers (e.g., an online subscription to your app).

Better news? You will only need to collect VAT from clients in the same zip code as your business. So if you’re using the Xolo Go invoicing or run an e-Residency company via Xolo Leap, you only have to collect VAT when invoicing other Estonian business entities or private persons.

In other cases, you can legally avoid paying VAT, thanks to the “reverse charge mechanism”. Essentially, if you invoice a client, located outside of Estonia, with a valid VAT number, then the VAT is marked as 0% due to the reverse-charge mechanism.

For other jurisdictions, please consult with a local tax advisor.

Optional: Discounts

Your invoice should also reflect any discounts you’ve promised to your client. A discount should be listed after the item price (e.g., $100) and then factored into the net amount due (e.g. $100-20% discount = $80 due).

Invoice payment method

The bottom area of the invoice is reserved for your payment details aka a destination, where the clients’ payment should go.

This can be:

- Your business bank account details

- A PayPal address

- Payment processing link

You have plenty of options for accepting client payments (discussed in the next section!).

Invoice payment terms

An invoice payment term is a clause that specifies the time frame in which a client must make the payment. It can also include late fees or other penalties that may be incurred if the payment is delayed.

The most common payments terms freelancers use are:

- Payment in advance: The invoice must be paid before work begins

- Due upon receipt: aka no later than the next business day

- Net 7/15/30: indicates a set number of days for settling an invoice

- X% 10 Net 30: the client will receive X percent discount for paying your invoice before the due date (Net 30 in this case)

- End of month: the invoice must be paid by the last date of the calendar month, regardless of its issue date

Freelancers favor shorter payment terms (everyone wants to get their hard-earned cash faster). But clients may not be as flexible. In the B2B space, the average invoice payment term is 66 days across sectors.

Larger (and legacy) businesses have notoriously long payment processing because of the rigid accounting systems and multi-stage approvals…which creates the following unhealthy dynamic:

How freelancers think about Net 30 payments: "I need my money within 30 days."

— Kat Boogaard (@kat_boogaard) March 1, 2023

How some clients think about Net 30 payments: "I'll start thinking about your payment on the 30th day (if I remember…maybe…we'll see 😏). AND NOT A MOMENT SOONER."

Source: Twitter

Your best strategy is to be upfront about your payment terms with new clients. State your preference for a shorter timeline and negotiate (if possible) for faster payouts.

Another tip? Mix different payment terms to maintain a good cash flow. If you already have several clients with rigid Net 30+ terms, make sure your newest ones either pay a project advance or can accommodate a “due upon receipt” clause. This way you’ll always have some cash on hand to power through the waiting periods.

Read more about financial management best practices for freelancers.

.png?width=2401&height=3892&name=03_Invoicing%20cheat%20sheet%20for%20freelancers%20(1).png)

Types of freelancer invoices

Most freelancers send standard invoices — a one-off invoice for service(s) or product(s) delivered, such as described above.

But on rare occasions, you might change up your invoice layout a bit to better reflect the nature of the transaction.

Here are seven other popular types of invoices freelancers send:

Proforma invoice

Proforma invoices provide an estimate of the work to be completed (with fees and taxes included). Unlike a standard invoice, a proforma invoice isn’t a demand for payment, but rather a preliminary evaluation of the final invoice the client will have to pay once you complete the task. The total amount in the proforma invoice can be changed to accurately reflect the actual work done.

In many cases, freelancers go with a project proposal (with a scope of work and price estimate) or a client price quote.

Debit invoice

A debit invoice, also called a debit memo, is used to request any extra payment on top of the original one. Typically, it is issued to compensate for previously unaccounted-for charges or fees (e.g., extra payment for out-of-scope work). For example, if the client already paid for your design services, but then requested modifications to a logo, you can issue a debit invoice for $250 for that extra work.

Credit invoice

A credit invoice, also called a credit memo, is used to compensate for any client overpayment. If you need to provide a client with a refund, a discount, or issue compensation for overbilling, you can issue a credit invoice with an outstanding total number. For example, if the client overpaid you by $100, you can send them a credit invoice for -$100 (followed up by a repayment).

Timesheet invoice

As the name suggests, a timesheet invoice reflects the hours you’ve logged for a specific client. It typically includes information such as the dates, total worked hours, and the nature of work performed.

Timesheet invoices are popular for hourly freelance contracts, where the client books you for a set number of hours at a fixed rate (e.g., 10 hours per week x $85/hour).

Recurring invoice

A recurring invoice is any type of invoice you regularly send to a client (e.g. every 15th of the month). It’s used for billing for ongoing services (e.g. retainers) and/or productized services (e.g., monthly social media content creation). The advantage of recurring invoices is that you get timely, consistent payments (and can manage your cash flow better!).

Moreover, you can auto-dispatch recurring invoices with an app like Xolo Go to save heaps of time on billing.

Interim invoice

An interim invoice gets issued before a project is completed, typically for large or ongoing engagements. The invoice serves as a request for payment for work completed up till a certain milestone (e.g., app wireframes delivered). Interim invoices help freelancers maintain a good cash flow while working on longer, more complex projects.

Final invoice

A final invoice is the last invoice you’ll send to a client within the scope of a specific project. Typically, it reflects any earlier payment terms and conditions (i.e., those stated in the proforma and/or interim invoice).

A final invoice includes the total amount owed, payments made so far (if applicable), the outstanding amount due by a specific date, plus applicable taxes. A final invoice indicates that the transaction is complete and that no further payment will be required.

Bonus: Expense reimbursement request

An expense reimbursement request, also called an expense report, requests compensation for any business-related expenses the client promised to cover (for example, premium font purchase). You can send an expense reimbursement request as a separate invoice or roll it into your final invoice.

Pro tip: As a freelancer, you can also reimburse business-related expenses via your company. Buying a new laptop with personal funds can be written off as a business expense and compensated with company funds (tax-free!).

How to get paid as a freelancer: 4 most-used ways

An invoice is a payment request, which must be settled via some payment method. Most freelancers choose to get paid via a bank transfer or a payment processing app (like PayPal, Stripe, Payoneer, etc).

Though some independent contractors also accept card payments in person (using a mobile cards reader like Square or SumUp) or accept old-fashioned paper checks (in some markets).

Cryptocurrency is another option, with 38% of US gig workers saying they’re open to getting paid in crypto.

Ultimately, it’s your call. Choose a payment method that works for your clients and your business too.

Bank transfer

Bank transfers are the most common way for settling freelance transactions. A client makes a direct deposit to your business bank, using the provided payment details (IBAN or account number).

European freelancers get to benefit from the Single Euro Payments Area (SEPA) — a banking policy, which enables (mostly) free, fast, and safe bank transfers anywhere in the European Union, as well as in a number of non-EU countries.

You can get a virtual SEPA bank account with Wise from almost anywhere in the world. Or open a business banking account with a digital bank like Revolut, N26, or another local provider.

Many digital banks also support multi-currency accounts, which allow you to accept payments in USD, GBP, or any other type of supported currency. This way, you can bill clients in their local currency and then benefit from competitive currency exchange fees such banks offer.

Pros

- Fast and secure payment processing

- Familiar payment method for most clients

- Almost instant access to business funds

- Payment processing fees covered by the client (in most cases)

Cons

- Long payment deposit times in some institutions

- High cross-border transfer fees

- Limited payment infrastructure in some countries

Payment processing app

Payment processing apps like PayPal, Stripe enable other ways for accepting client payments — via a payment link or a debit/credit card processing. The money arrives instantly, plus the client doesn’t need to type in any banking deets.

The downside of the fast and seamless payment experience is the added transaction processing costs (which are for you to cover). Stripe takes a 2.9% + 30¢ cut per each successful card charge, while PayPal likes to sneak in some hidden fees for cross-currency payments. These add-up fast, especially for big-ticket projects.

Also, popular payment processing apps often have geo-restrictions. For example, PayPal India discontinued domestic payment transactions and now only supports businesses for cross-border transactions. While PayPal Ukraine only allows B2C payments. You cannot hold a business account with them. Likewise, Stripe is available only in 47 countries (mostly in North America and the EU).

Pros

- Immediate payment processing

- Hassle-free payment experience

- In-built anti-fraud protection

Cons

- High transaction costs

- Restricted availability

- Long dispute resolution process

- Client-favoring chargeback policies

Invoicing software

You can also access a range of payment processing services via invoicing software providers. In this case, you get the double benefit of streamlined invoice generation and payment.

Popular invoicing apps have integrations with banking service providers and payment gateways, which allow you to accept payment by transfer, card, or even crypto.

Psst, you can get access to European payment infrastructure with Xolo Go — an invoicing app that allows you to legally invoice clients in 186 countries without incorporating a company. Each user gets a business bank account (IBAN) for accepting multi-currency payments. And you can then withdraw all the earned funds to your linked personal bank account within 24 hours.

Pros

- Easier recordkeeping and invoice tracking

- Access to multiple payment methods from one interface

- Extra productivity features like recurring invoices, expense management, and more

Cons

- Extra monthly and payment processing fees

- Spam filters may hide certain invoices

How to invoice and get paid by international clients as a freelancer?

Cross-border operations are a norm for most freelancers (since you can digitally reach clients from any point on the planet). But international invoices come with the extra challenges of currency conversion fees (which can be steep), asymmetry in local payment methods (e.g., inability to use PayPal), and tax compliance requirements (e.g., the need to possess a valid VAT number).

To get easily paid by international clients, ask about their preferred invoice format. Most clients will have an invoice template you can use (or you can get one from your invoicing software provider). Then set up a multi-currency business bank account (to avoid cross-border fees). Share your local banking deets with a contact and negotiate who covers the payment fees (if any are applicable).

How to handle VAT when invoicing as a freelancer?

VAT is due on all invoices sent to a local business (e.g., if you’re incorporated in the UK and invoice a UK business, a 20% VAT rate applies). After the client pays your invoice, you must remit the collected VAT sum to a local tax authority.

NB: VAT rate must be added as a separate invoice line. It cannot be rolled into your product or service price.

That said, you don’t need to collect VAT whenever you’re working with clients outside of the EU, plus those located in another EU country (e.g., France) thanks to the “reverse charge” mechanism.

How to track invoices as a freelancer?

To avoid delays in client payments, create a simple invoice tracking system:

- Create an invoice log system in a spreadsheet.

- List client name, project type, invoice issue date, and due date.

- Color-code each paid invoice in green

- Color-code each overdue invoice in orange

- Schedule automatic email payment reminders for overdue invoices

You can automate invoice logging using a Zapier automation recipe.

Or — better still — use an invoicing app that will do those chores for you: Notify about overdue invoices and send automatic payment reminders to clients (without the added emotional baggage for you 😉).

Source: LinkedIn

How to chase clients for late payments as a freelancer?

Your best tool for chasing late payments is email follow-ups. Create an automated email sequence for “polite, but firm” reminders on overdue invoices. It should include three emails (sent with a 3-7 business day delay).

The first email is a gentle reminder about the outstanding payment. The second one should have a firmer tone and instill urgency. The third email is when you pull out some leverage — remind about the legal implication of non-payment such as a collection of penalty fees and follow-up court action.

P.S. As a last resort, you can ask your lawyer friend for a favor to send a Letter Before Action. Or ask ChatGPT to write a “scary payment collection email” like one savvy freelancer did. (Surprisingly, it worked!).

Imagine a multi-billion dollar client who refused to pay you for good work rendered. Most people would turn to lawyers

— GREG ISENBERG (@gregisenberg) February 24, 2023

I turned to ChatGPT

Here's the story of how I recovered $109,500 without spending a dime on legal fees:

Source: Twitter

Best practices when invoicing as a freelancer

Invoicing gobbles up a ton of your time and energy unless you take charge of the process.

- Set clear payment terms with clients. Mention your payment terms during the project negotiation stage and put them into writing in the work agreement. Doing so saves you from awkward conversations and late payment issues down the road.

- Establish a clear billing and invoicing schedule. Build an extra financial cushion by asking for project deposits or milestone payments (for long-term projects). Collect payment upfront for retainer services and maintain a handful of bigger clients on longer net payment terms.

- Send professional, clear invoices. Spell out the project deets, itemize all spending, and include all applicable taxes and fees. Clients (and their accounting peeps) must get a clear snapshot of your payment request.

- Invest in the right invoice processing software. Select an invoicing app with integrated payment processing, automatic invoice tracking, reminders, and payment reconciliation to keep an organized invoice trail.

And if you need a one-stop-shop invoicing solution that lends you extra liability protection, affordable cross-border payment processing, and neat accounting tools, check out Xolo Go!

About Elena

Elena Prokopets writes content for tech-led companies & software development businesses, marketing to them. Her empathy for the customer, expertise in SEO, and knack for storytelling help create content that ranks well and drives industry conversations.

Elena uses Xolo so she can focus on her solo B2B content writing business without stressing over the compliance and admin overhead.

Related blogs

Subscribe to

our newsletter

and get the latest updates and expert

business tips straight to your inbox.