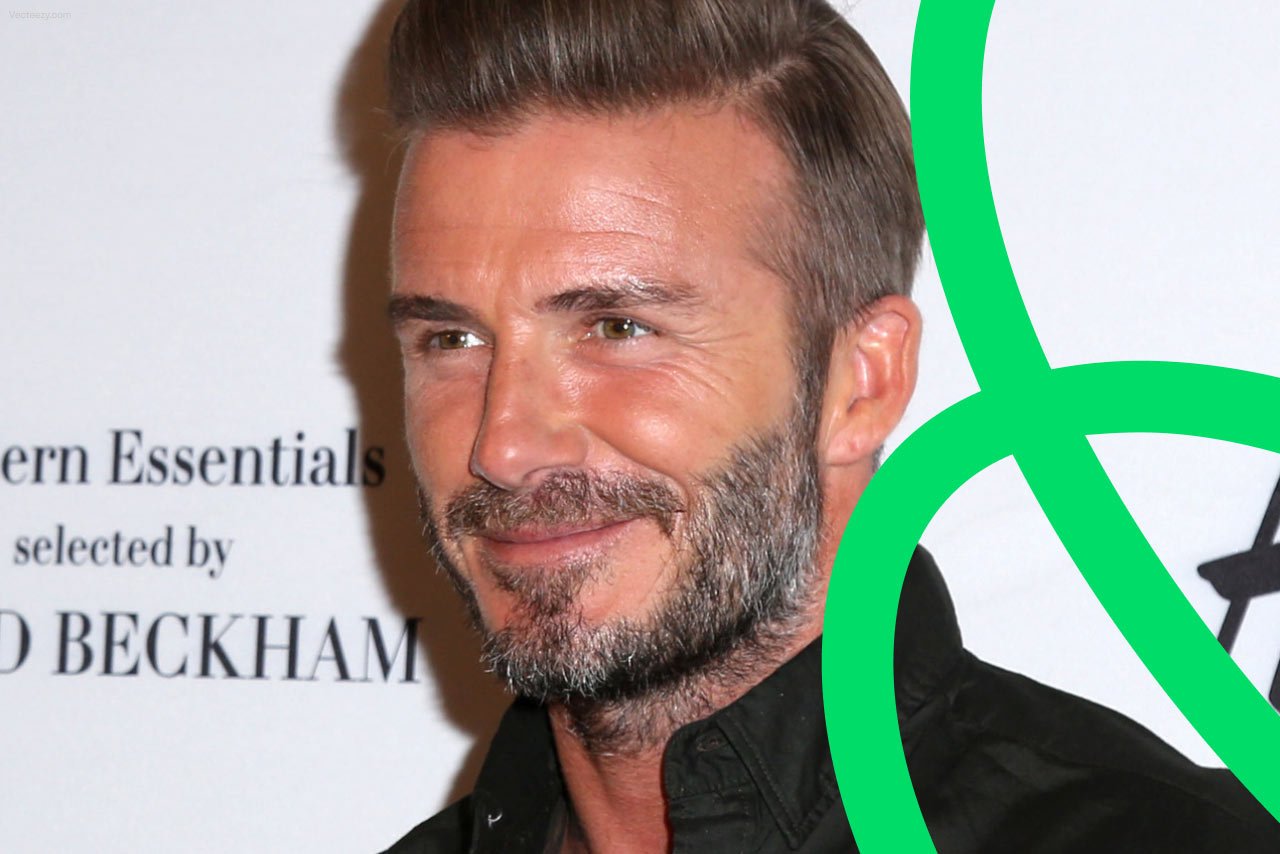

When David Beckham started kicking around in Spain, he was met with a harsh system that depleted an immense amount of his earnings through taxation. Happy to have a leaguer like Beckham performing in Real Madrid, the Spanish government responded by creating the Beckham Law, more boringly known as the Impatriate Regime.

Since 2015 this law no longer applies to sports activities, but if you’re not here because of pro-football reasons, then you stand to benefit from being a Spanish resident in need of lower taxation

What is the Impatriate Regime, or Beckham Law?

This law allows first-time visitors to Spain a strong amount of tax leeway during their first year in-country as a resident, and potentially up to five years following – but it’s not for everyone.

During that first year, those who qualify for this bracket only pay non-resident income tax (NRIT) while still having it qualify as personal income tax (PIT). This allows for possibly lower (or zero) taxes to be paid in Spain for income and capital gains earned abroad, and a 24% fixed-rate for entrepreneurial work done outside of Spain up to €600k.

Because this tax regime is voluntary, those who wish to be a part of it are required to apply for it. Which begs the question…

Who can apply for the Impatriate Regime, or Beckham Law?

Spain introduced a Start Up law in 2022 that changed this tax regime for the better, opening up the system for a broader range of users. Previously only those who’d been relocated by their employer could qualify, but today freelancers can apply if they meet certain criteria.

Thanks to a new approval of regulations being made in December 2023 (article 113 of RIPRF if you’re interested) we’re now more easily able to specify the necessary criteria to snag you a bigger chunk of your income. Today this is open for the following:

- Employees who’ve been relocated to Spain

- Company managers who move to Spain for work-related reasons

- Freelancers/autónomos who:

- Have an ENISA report

- Have a VISA of Highly qualified people and render service to Spanish emergent companies according to artículo 71 de la citada Ley 14/2013 (it is necessary to provide the accredit of the company before the commercial registry as an emergent company and a contract to demonstrate the service among both parties)

- Perform activities of training, research, development and innovation when they have the VISA previewed in artículo 72 de la Ley 14/2013

Until when can I apply for the Impatriate Regime, Beckham Law?

The law states that the regular period for freelancers to apply is 6 months since their first day in Spain, but the Tax Agency still doesn't have the request form approved.

A special provision is now in place allowing first-time Spanish residents who moved to Spain in 2023 before December 16, and already spent more than 6 months in the country, to apply for the Impatriate Regime within a new six-month window beginning from December 16.

New residents who’ve entered Spain after December 16 are still required to apply within the standard timeline of 6 months from their first day of entry.

What tax benefits do I gain with the Impatriate Regime, Beckham Law

Paying taxes is nobody's favorite game (except our Xolo accountants perhaps), but it is a necessity that cannot be overlooked. However, it can become a little more fun when you realize you’re eligible for a break, cut, exemption or return.

The Impatriate Regime offers exactly that to those who qualify for it, and here we’ll break down the benefits bit-by-bit:

- Income from work, declared globally from Spain

- Flat rate of 24% up to €600,000

- Flat rate of 47% from €600,001

- Other income, declared from Spain

- Wealth tax obligation for ‘real’ obligations, if your total wealth in Spain (excluding a home) exceeds €700,000

- Not required to submit 720 (informative declaration of assets +€50k abroad)

Those who qualify for these benefits are able to use them during a large period of their residency:

- First year of tax residency

- Five years following

Am I eligible for the Impatriate Regime with a nomad visa?

The short answer is “No” despite the two being regulated similarly and through the same body of government. This confusion exists because the Start Up law is part of the same regulatory body:

- Corporate Tax regulation for startups

- Modifies the Corporate Income Tax regulation

- Creates the international teleworker visa

- Modifies certain regimes, among them the Impatriate Regime (Beckham Law)

Although it is true that everything is under the same regulation, the laws that dictate them are different and the requirements to access each situation are different. For example:

- In order to meet the criteria for the nomad visa, at least 80% of your sales invoices must be issued to clients outside of Spain

- In general, to meet the Impatriate Regime criteria, you would need to have the larger part of your activity in Spain, dedicated to a Spanish entity, or have the Enisa report or a special visa, that as stated above, is not the nomad visa

Is it always beneficial to apply for the Impatriate Regime, Beckham Law?

While it may naturally seem that any special tax regime should be wonderful, the Impatriate Regime isn’t for everyone. In general terms, we’d recommend applying if you meet the initial criteria and:

- Plan to have an average net income (benefit in your economic activity) of at least €50,000 per year

- You have multiple investments abroad that provide you with extra incomes annually

How can Xolo help me?

🎉 We can take care of all the paperwork for you! Just sign up and we’ll handle the application process, autónomo registration (if needed) and all the following business admin.