How to choose the best online billing and accounting platform for freelancers in Spain

on agosto 22, 2023 • 6 min of reading

As a freelancer, you’re your own boss — yay! But you’re also your own HR, IT, finance, branding, and sales department — boo! Clearly, nobody can be a pro in all these areas. That’s why companies hire experts in each area. So how can expat freelancers like you replicate that expertise when you’re the only one in the business?

With technology of course!

When you know what to look for, you can significantly reduce the stress of freelancing in Spain from a simple online platform. In this article, we’re going to discuss:

- Essential features of a freelancer billing and accounting platform

- How you can streamline your daily business processes

- Top tips for choosing the best software for you

- A platform that ticks all the boxes. (Hint hint, it’s Xolo!)

What to look for in online billing and accounting software for freelancers

If you’re new to freelance accounting, it’s easy to be overwhelmed with what you actually need to do and what is overkill. So rather than letting you go through the painful trial-and-error phase, we’re going to fast-track your learning curve with the most valued features in online billing and accounting platforms.

1. An automated invoice creation tool

As a general rule, you should always be suspicious of anyone who knows Excel too well. And while invoices-via-spreadsheet worked better than pen and paper, the Excel era has gone the way of the MiniDisc.

It’s easy to see why. Rather than delicately tying your questionable homemade formulae together, the best online billing and accounting platforms allow you to create professional, compliant invoices by simply filling in a few easy boxes. Yes, it’s important to know what to include on a freelance invoice, but automated software makes sure you’ve got everything the Spanish government asks for.

It’s a quick and easy process. Once you land a new client, upload their name, address, VAT number (if applicable), and contact person to receive the invoice via email. When it comes to creating your invoices, select your client and all those details will appear with the click of a button.

At Xolo, we know a lot of you freelancers have that global mindset so our invoicing software allows you to choose the currency you need. Then you’ll fill in a description of your services, the number of jobs completed, and your rate. Once you’re ready, click send, and your sleek-looking invoice will make its way to the contact email from your client details.

2. A variety of customizable invoice templates

It’s not just about staying compliant though. As a solo, you want to stand out, and with customizable invoice templates, you can do just that. It’s a little thing, but it’s the little things that make up life. Sending an invoice with your own branding shows a level of professionalism that instills confidence in your clients.

3. Tax forecasting

One of the worst parts of being a freelancer has traditionally been the mad rush at the end of a trimester as you scramble around, gathering information for your quarterly tax returns. But with invoicing and expense management, everything you need is already on the system, ready to submit when it’s time to send your tax reports.

These real-time updates help with another bugbear for freelancers in Spain: Tax forecasting. Rather than the guesswork of predicting your tax bill, online billing and accounting software like Xolo cuts out the uncertainty and shows your future tax bills on your dashboard so you can better manage your finances.

4. Expense management

Speaking of managing your finances, billing and accounting software is a boon for calculating the impact of your deductible expenses. Expenses are notoriously difficult to track, so it’s no surprise that freelancers in Spain use online tools to calculate their expenses.

But Xolo isn’t just a set of clever algorithms. Our expert accountants will give you a full assessment so you can take advantage of every opportunity to reduce your tax bill. From meals with clients and petrol for your work car to social security payments, software, and household bills, we make sure you’re saving every cent.

5. Quality assurance

As a final point, when looking for a billing and accounting platform for freelancers, don’t ignore what happens when things go wrong. Of course, a program will always have fewer errors than a human. But when things go wrong, who is going to take responsibility for it? Make sure you have access to a team of people who will recognize your issues and get to work resolving them so you can keep your show on the road.

A simple checklist for choosing an online billing and accounting platform for freelancers

If you already had a few tools in mind, you might have rejected one or two after reading our section on features. But with this checklist of considerations, we’ll go beyond the spec list and explore how the usability of billing and accounting platforms is best for a freelancer in your position.

1. Intuitive and easy to use

Of course, there are some seriously powerful platforms out there with all the bells and whistles. But just as you wouldn’t take a Ferrari to go to the grocery store, most freelancers don’t need the same invoicing software as multinationals. So, when choosing your billing and accounting platform, take a look at how neat and simple the examples look and if they prioritize a user-friendly layout.

2. Accessible from anywhere

If you’re the kind of freelancer who loves the jet-set life, you’ll need your accounting to come with you. Almost all billing software is hosted on the cloud, so you can always access it with a laptop and an internet connection. But don’t overlook a good mobile app and a way of working offline if your internet connection doesn’t quite reach the white-sand beach you’re working from.

3. Within your budget (without skimping on features)

Free tools are a tantalizing prospect for new freelancers, but you need to think about the bigger picture. Most free options are in fact “freemium”, giving you a taste of the tool but without key features, meaning you end up paying anyway. Remember that business-related software will always qualify as a deductible expense too!

4. Reliable technical assistance

Ask yourself whether there are actual humans behind your billing and accounting platform. It’s great having a free tool until something goes wrong on deadline day and you get in trouble for late tax returns. Look for software that comes with a team you can rely on to answer questions and solve issues quickly.

5. Compliant with local laws and regulations

If you’re an expat freelancer in Spain, you probably aren’t aware of all the rules and regulations you need to follow to stay compliant. In truth, most Spanish people would have trouble explaining how deductible expenses work. Therefore, if you can get your hands on a tool like Xolo that keeps you on the right side of the Spanish legal system (and plenty more countries if you decide to move!), you can save yourself a huge amount of time and stress.

Why more than 100,000 solos put their trust in Xolo's online billing and accounting software for freelancers

At Xolo, we hate to blow our own trumpet. But that’s fine because our customers do it for us 🙏. All we aim to do is to make difficult things easy so freelancers like you can stick to what you do best instead of drowning in admin and red tape. So, as much as it pains us to say it, here’s why we’re the best billing and accounting platform for freelancers in Spain.

We’re 100% digital, just like you

Let’s face it, there’s a lot the digital world gives us. From card payments to finding a date, there’s an app for pretty much everything.

And while traditional agencies do processes manually, Xolo is an online headquarters for all your accounting and invoicing needs. Always up to date and never leaving room for human error, we’re the fastest, most reliable way to get your freelance admin done.

No more unnecessary trips to the tax office, we’ll streamline every step of the way so you can concentrate on building your business.

We adapt to your specific needs

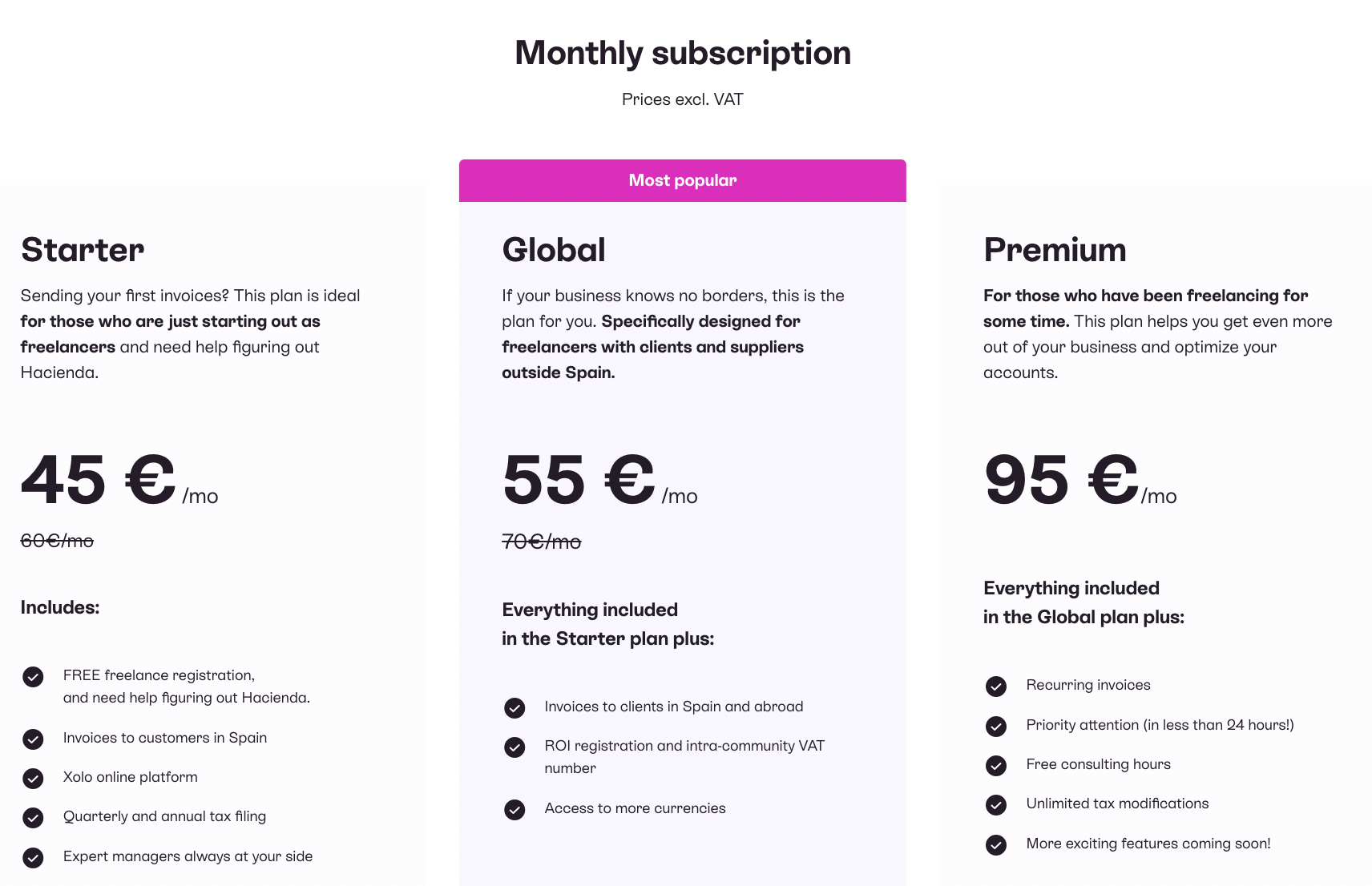

Whether you’re a local business serving your neighborhood or a global supplier for clients all over the world, we have different rates so you can choose what suits you best:

We’re available by phone or email

Sure, we’re a digital agency, but that doesn’t mean we’re not human! Automated digital processes mean we’re quick and efficient, but we know it’s sometimes better to talk things over. Our team is available via phone or email so you can get the kind of service that works for you.

Our advice is free of charge from day one so you can stay on top of your game throughout your time at Xolo.

We talk to you in English or Spanish

Freelancing is hard enough without having to learn Spanish legalese. Our team of experts offers advice in English or Spanish and breaks down tricky concepts into plain, everyday language.

We take responsibility for your accounting

We’re safe and reliable so you never have to worry about the tax authorities coming for you.

And we are not just saying that. Xolo is a member of ASEFIGET, an association dedicated to representing and serving tax professionals, and uses the government’s CIRCE system to carry out all freelance procedures remotely.

We’re a community

At Xolo, we’re proud to be much more than an invoicing and expense management platform for freelancers. We’re a partner in your self-employed life. So if you want to boss your accounting and get a whole host of other benefits in the mix, sign up to Xolo today!

About James

James McKenna has been a freelancer since 2017, working in subtitling, translation, and his main passion — writing. He loves nothing more than falling down a rabbit hole, a habit that has helped him specialize in areas as diverse as biotech, climate change, higher education, and business strategy.

Based in Barcelona, James learned the ropes the hard way, making mistakes that turned into valuable learning experiences. After working hard to establish himself, he is now working smart, and is always on the lookout for ways to streamline his business.